Global Plastic Needs Matching Service

Our Product: Plastmatch

Plastmatch (a Sinolong Group brand, also known as "专塑视界") uses AI to connect global plastic buyers with Chinese polymer exporters. It provides smart matching, global company search, and digital marketing tools. With tailored insights, Plastmatch helps you discover opportunities, reduce costs, and boost efficiency in the polymer trade. As your AI-driven strategic partner, Plastmatch simplifies global sourcing.

3M+

Global App Downloads

2M+

Global Company Database

1000+

Daily Updated Global Business Leads

Features

Industry Dynamics

Pop Mart vs. Bambu Lab Copyright Dispute: Both Sides Clash Over "Pre-Litigation Communication"

2026-03-09 20:12:21

The copyright infringement dispute between China's leading plush toy company Pop Mart and 3D printing unicorn Tiertime is about to escalate into a legal battle.

The case will officially go to trial on April 2.

This infringement dispute originated fro

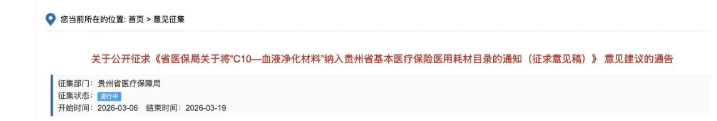

Large Batch of Hemodialysis Supplies to Be Covered by Health Insurance

2026-03-09 20:09:15

Policy incentives continue to emerge, and the domestic hemodialysis market is accelerating its expansion.

01 Guizhou New Policy:

Inclusion of blood purification consumables in the medical insurance catalog

On March 6, the Guizhou Medical In

International Oil Prices Swing Sharply! Huicheng Environmental Protection’s 200,000-Ton Facility Successfully Passes Critical Test—Where Does the Industrial Chain Confidence Come From?

2026-03-09 19:47:40

Middle East Conflict Intensifies, Driving Surge in Polyolefins

2026-03-09 19:45:10

260 Million Yuan! Nantong to Build Polylactic Acid (PLA) Bio-Based Automotive and Household Air-Conditioning Filter Project

2026-03-09 19:06:17

LG Chem Declares Force Majeure on DOTP Exports! SABIC Joins Five Giants to Redefine EV Safety

2026-03-09 18:59:43