Pop Mart vs. Bambu Lab Copyright Dispute: Both Sides Clash Over "Pre-Litigation Communication"

2026-03-09 20:12:21The copyright infringement dispute between China's leading plush toy company Pop Mart and 3D printing unicorn Tiertime is about to escalate into a legal battle. The case will officially go to trial on April 2. This infringement dispute originated fro

Large Batch of Hemodialysis Supplies to Be Covered by Health Insurance

2026-03-09 20:09:15Policy incentives continue to emerge, and the domestic hemodialysis market is accelerating its expansion. 01 Guizhou New Policy: Inclusion of blood purification consumables in the medical insurance catalog On March 6, the Guizhou Medical In

International Oil Prices Swing Sharply! Huicheng Environmental Protection’s 200,000-Ton Facility Successfully Passes Critical Test—Where Does the Industrial Chain Confidence Come From?

2026-03-09 19:47:40In early 2026, the escalating tensions between the US and Iran led to the disruption of navigation in the Strait of Hormuz, causing significant fluctuations in international crude oil prices. Global energy security and the stability of the petrochemi

Middle East Conflict Intensifies, Driving Surge in Polyolefins

2026-03-09 19:45:10Recently, the conflict in the Middle East has continued to escalate, spreading from localized confrontations to the vicinity of core petrochemical production areas. Coupled with the rising shipping risks in the Strait of Hormuz, the global polyolefin

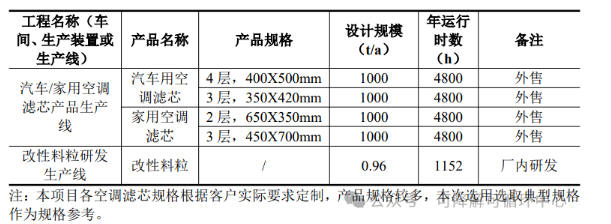

260 Million Yuan! Nantong to Build Polylactic Acid (PLA) Bio-Based Automotive and Household Air-Conditioning Filter Project

2026-03-09 19:06:17March 9,Nantong Jiajun Biomedical Materials Co., Ltd.Project Announcement for Bio-based Material Products (Including Automotive and Household Air Conditioning Filters) A total investment of RMB 26 million is planned to procure automatic mixing machin

LG Chem Declares Force Majeure on DOTP Exports! SABIC Joins Five Giants to Redefine EV Safety

2026-03-09 18:59:43International News Brief Feedstock: LG Chem declares force majeure on Di-Octyl Terephthalate (DOTP) export contracts. Recycling: US scientists develop new flexible plastic recycling technology for polypropylene and polyethylene. Automotive: A trillio